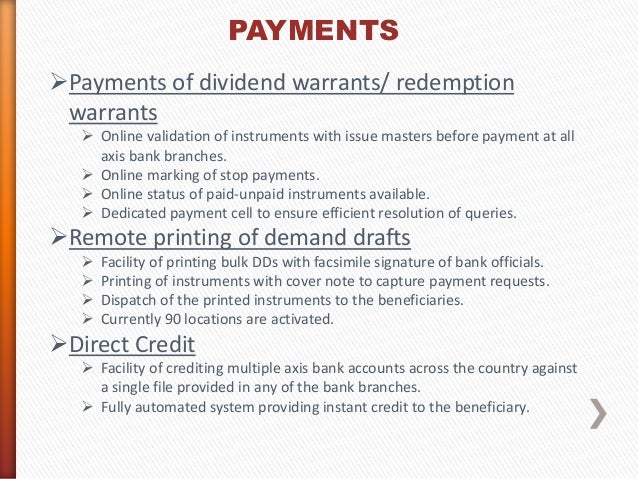

Payment of cash dividend to preferred stockholders,.Payment of cash dividend to common stockholders,.Issuance of bonds (i.e., long term bonds payable),.Obtaining cash from preferred stockholders by issuing them the preferred stock,.Obtaining cash from common stockholders by issuing them the entity’s common stock,.Some examples of cash flows from financing activities are listed below: Treatment of interest on debt and dividend on stock.Understanding cash and non-cash financing activities.Such creditors are known as trade creditors and cash paid to them is included in the operating activities section of the statement of cash flows. The payment made to creditors for purchase of raw materials or merchandise inventory is not reported in financing activities section. Here, the creditors mean the creditors for non-trading liabilities such as bonds payable and long term loans etc. It generally involves flow of cash between the company and its sources of finance i.e., owners and creditors. Gatekeeper should then charge the $500,000 to expense over the normal course of the bridge construction project, based on milestone and completion payments.Financing activities section is the third and last section of the statement of cash flows that reports cash flows resulting from financing activities of a business. Gatekeeper should measure the 1,000,000 warrants at the performance commitment date, which have a fair value of $500,000. The forfeiture clause is sufficiently large to classify the arrangement as a performance commitment. IBD agrees to forfeit $2,000,000 of its fee if the bridge has not been completed by that date.

Gatekeeper agrees to pay IBD $10,000,000 for the work, as well as an additional 1,000,000 warrants if the bridge is completed by a certain date. It contracts with International Bridge Development (IBD) to build a bridge along the toll way. Gatekeeper Corporation operates a private toll road. Additional Example of Stock Warrant Accounting In both cases, the company should record the fair value of the instruments when granted, and then adjust the recorded fair values when the remaining provisions of the agreements have been settled.

The option agreement contains a provision that the vesting period will be reduced to six months if a project on which the grantee is working is accepted by an Armadillo client by a certain date. In another arrangement, Armadillo issues warrants that vest in five years. The option agreement contains a provision that the exercise price will be reduced if a project on which the grantee is working is completed to the satisfaction of Armadillo management by a certain date. Example of Stock Warrant AccountingĪrmadillo Industries issues fully vested warrants to a grantee. If there is a performance condition, the grantee may have to alter the amount of revenue recognized, once the condition has been settled. The grantee should recognize the fair value of the equity instruments paid using the same rules applied to the grantor. The grantee must also record payments made to it with equity instruments.

Also, recognize the cost of the transaction in the same period as if the company had paid cash, instead of using the equity instrument as payment. If early exercise is granted, measure and record the incremental change in fair value as of the date of revision to the terms of the instrument. If the grantor issues a fully vested, nonforfeitable warrant that can be exercised early if a performance target is reached, the grantor measures the fair value of the instrument at the date of grant. Note that forfeiture of the warrant instrument is not considered a sufficient disincentive to trigger this clause. The measurement date is the earlier of the date when the grantee’s performance is complete or the date when the grantee’s commitment to complete is probable, given the presence of large disincentives related to nonperformance. The grantor usually recognizes warrants as of a measurement date.

0 kommentar(er)

0 kommentar(er)